President Donald Trump is renewing his call to Congress to pass the Tax Cuts and Jobs Act, or as he calls it, “one big, beautiful bill.” The 2017 law is set to expire at the end of the year and could cost taxpayers thousands the next time they file.

A new Fabrizio, Lee & Associates poll found an overwhelming percent of voters believe they will struggle to pay for everyday expenses if taxes were to rise. Regardless of political association, taxes and inflation cause major concerns. Pete Sepp, from the National Taxpayers Union, spoke to the Washington Examiner about the possible economic impact if Congress were to let the 2017 tax policy expire.

“The costs are major,” Sepp said. “They’re, in fact, catastrophic. When you look at the whole economy, some studies have shown that as many as 6 million jobs could be lost. As much as $500 billion in wages could be lost, and upwards of $1 trillion of economic growth could be at stake.”

Sepp said the median income household could see upwards of $2,000 more in taxes next year. If you account for the child tax credit, families could lose $1,000 per child. Small businesses would lose the ability to immediately write off equipment they’re investing in.

“All of those things would amount to a massive economic slowdown for businesses and for families,” Sepp said.

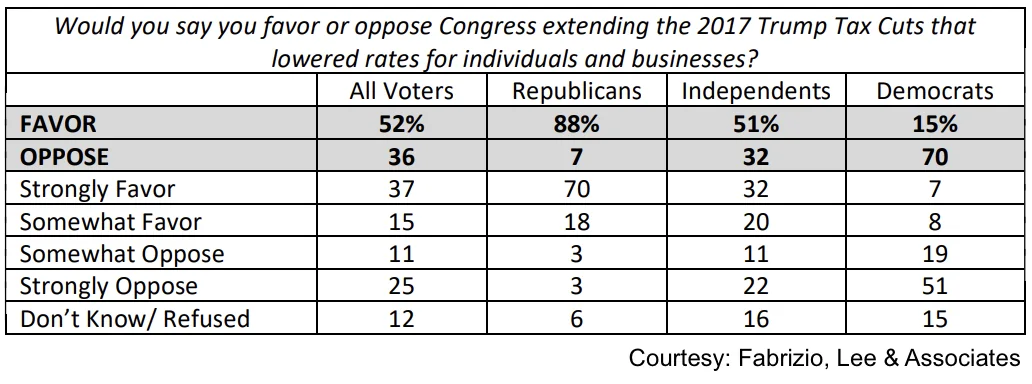

While the Trump administration argues the extension could give “the largest tax cuts in history to the American people,” voters do not seem to agree. Only 52% of voters surveyed support extending the 2017 Trump tax cuts. This particularly skews Republican with 88% in favor, which is in stark contrast to the only 15% of Democrats who are in favor of extending the cuts.

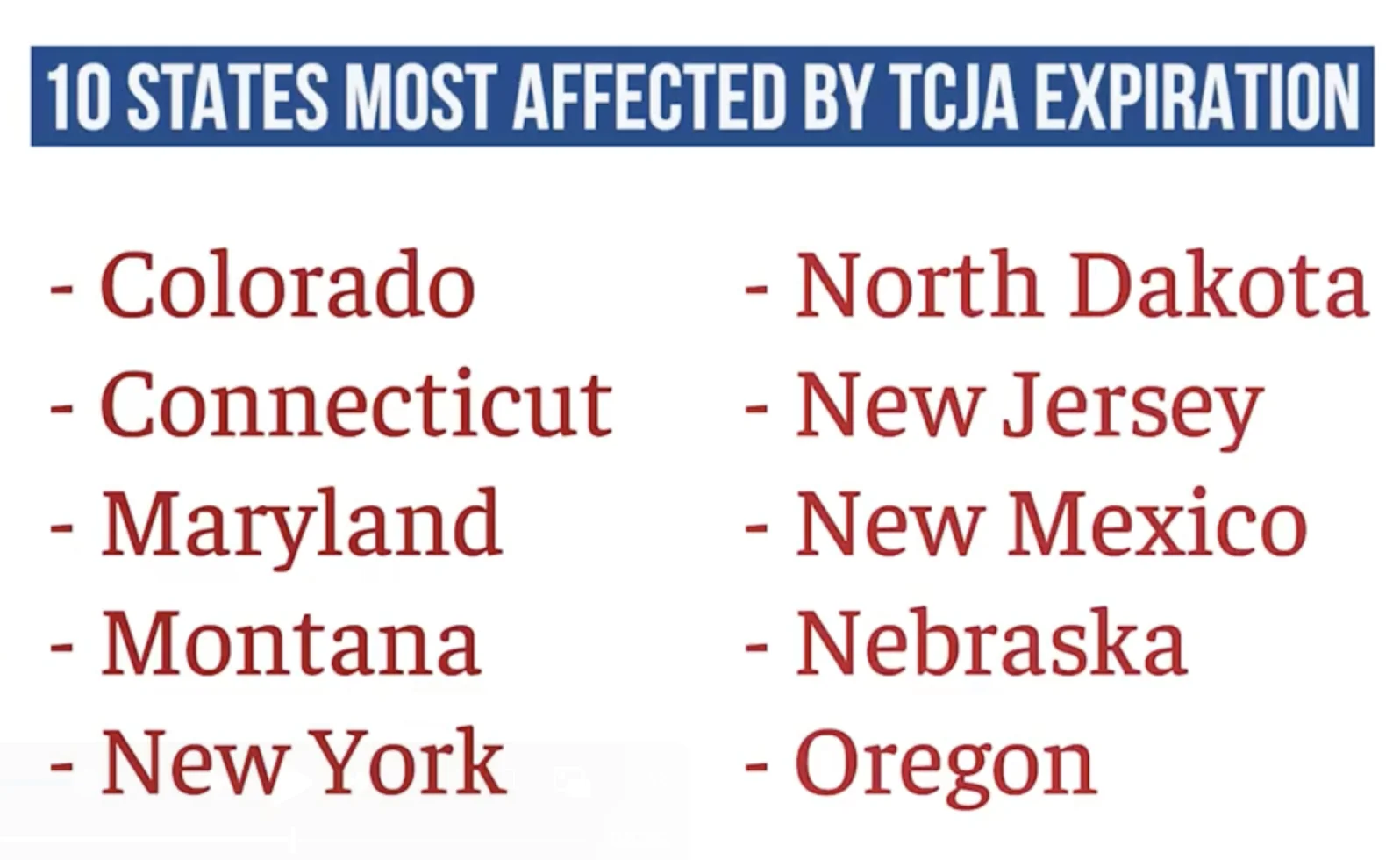

However, Sepp claims both have something to lose, as blue and red states are equally affected because many states tie their tax systems to the federal model.

“The definitions of income, what’s taxable, what’s deductible, what kinds of credits you can take, are mirrored in these state systems,” Sepp said. “And so you have states like Colorado, Connecticut, New Jersey, among the most affected. Those are blue and purple states, not just red states.”

Sepp claimed the Tax Cuts and Jobs Act not only saved money but time as it simplified the tax system, making it easier and less expensive to file taxes. The standard deduction was doubled, and the alternative minimum tax was eliminated, reducing complexity.

INSIDE SCOOP: ELON’S EXIT, PETE’S PENTAGON PROBLEMS, AND AFTER 100 DAYS CAN TRUMP STILL BLAME BIDEN?

“What that did, in total, was allow people to file their taxes with less time, less out-of-pocket expense, less hassle,” Sepp said. “It simplified the system. We would lose all of that simplification if the tax cuts and Jobs Act were allowed to expire.”

The Tax Cuts and Jobs Act is scheduled to sunset on Dec. 31. Trump has proposed additional policies in the extension, including no tax on tips, no tax on overtime pay, and no tax on Social Security. The price tag for this “big, beautiful bill” is $7 trillion. The question now is: Who is going to pay for it? Trump has already promised higher taxes on U.S. imports through tariffs. Though those are still under the 90-day pause until July, giving time for countries to renegotiate.