Interest costs will outpace defense and non-defense discretionary spending by 2030

Tiana Lowe Doescher

Video Embed

In the short run, the Federal Reserve has saved President Joe Biden from himself. The central bank’s monetary tightening has sufficiently offset the explicitly inflationary fiscal policy of the White House to the extent that inflation fell from its near-double-digit highs last year to about 4.6%, per the Fed’s preferred measure of core personal consumption expenditures. But in the long run, the Fed’s mandate to restore price stability will run afoul of the government’s bipartisan resolve to continue to expand spending — and worse, do nothing about projected mandatory spending explosions.

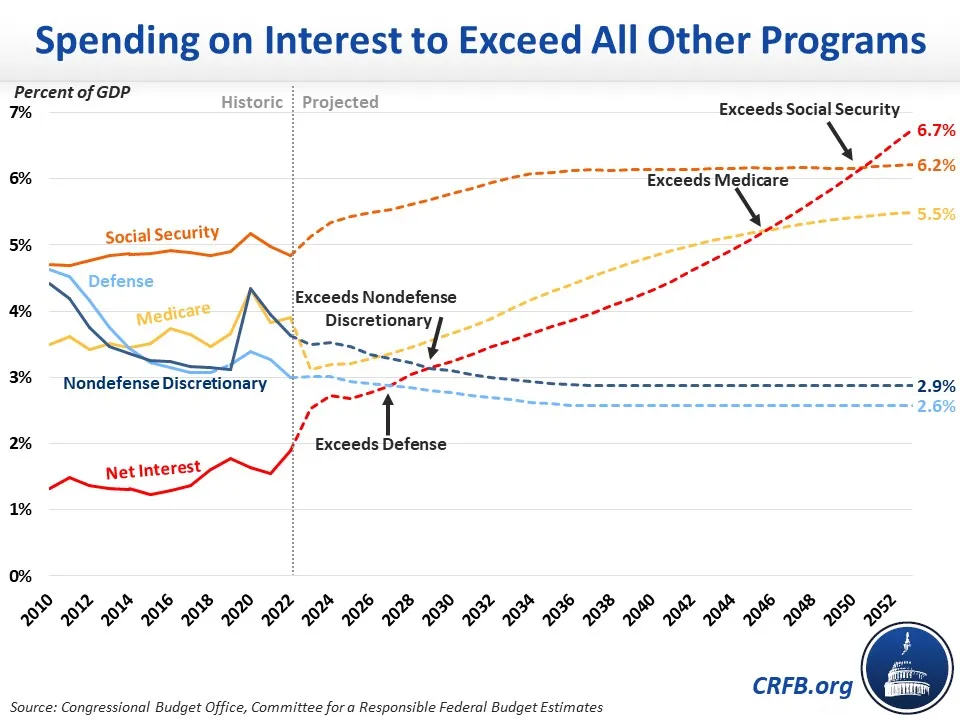

For a visual aid, here is a chart from our friends at the Committee for a Responsible Federal Budget illustrating the latest spending projections from the nonpartisan Congressional Budget Office.

CRUEL SUMMER: BIDEN FACES BRUISING FEW WEEKS OF SETBACKS AND SCANDAL

As you can see, by 2028, projected payments on interest on the national debt will have outpaced defense spending as well as non-defense discretionary spending. By 2046, interest payments will amount to more than Medicare, which is already projected to cost more than 5% of our annual economic output by that time. And by 2051, net interest payments will surpass Social Security costs, becoming the single largest expense of the federal government.

To put this into perspective, imagine a hypothetical budget on a credit card. If you’re smart, you want to pay off your credit card bill in full every month, but let’s say you have to let a balance roll over. Imagine the interest on that balance costing as much as you pay on groceries every month, or within the year, totaling what you pay on gasoline. Then imagine your credit card interest costing more than every other category on which you spend, including your mortgage or rent.

That is where the federal government is heading, not in the unforeseen future, but when today’s infants are adults, when most middle-aged people will still be alive and dependent on Social Security (which sees a 24% across-the-board cut in a decade if Congress does nothing to reform it).

CLICK HERE TO READ MORE FROM THE WASHINGTON EXAMINER

And remember, these are just the projections of the CBO, which is ruthlessly optimistic about interest rate estimates. Brian Reidl of the Manhattan Institute puts the risks into perspective.

And remember, undergirding all of this is the fact that the Fed has had to continue to increase interest rates specifically to offset the inflationary fiscal policy chosen by both Biden and Congress. While investors remained dangerously dovish in their expectations of rate hikes for far too long, futures markets are finally pricing in the possibility of another three rate hikes this year. In other words, rates are likely to get higher and stay there for longer, driving all the costs above much, much higher.