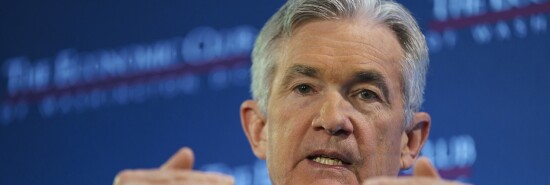

Soaring February inflation gives Jerome Powell the case to defy investors

Tiana Lowe

After the Biden administration agreed to bail out the non-FDIC-insured deposits of the failed Silicon Valley Bank, Wall Street restored its hope that the Federal Reserve would slow down its monetary tightening. Investors — who waited through weeks of Chairman Jerome Powell insisting that the Fed’s fight against inflation was far from over before pricing in a 50 basis point hike of the federal funds rate — have quickly returned to the expectation that the central bank will continue to slow down rate hikes to 25 basis points or even halt them entirely.

However, news that the consumer price index continued to soar from January to February makes Powell’s case for ramping up the rate hikes much more obvious.

SENATORS MAKE THE CASE FOR THE FEDERAL RESERVE’S INDEPENDENCE

After rising by half a percentage point in January, the CPI increased by 0.4% in February. However, core inflation from month to month actually accelerated, with core CPI increasing by 0.5% in February from 0.4%. Although inflation over the past 12 months fell from 6.4% to 6%, February’s core CPI is higher than that of the last three months and the last six months.

The Fed has stood relatively firm against perennially dovish investor expectations, but the Silicon Valley Bank bank run, orchestrated by venture capitalists, and subsequent bailout, also demanded by venture capitalists, is the first real test for whether Powell and the Fed’s hawks can hold to the central bank’s constitutional mandate of restoring price stability and ignore the whining on Wall Street.

The fragility of Silicon Valley Bank was specifically created as a result of the Fed’s failed experiment of printing 40% of all U.S. dollars in a three-year time span. SVB, like too much of the post-Great Recession financial industry, assumed the money printer would never turn off and the cost of borrowing would remain near zero. The Fed must inflict pain to quash the inflation of its own creation, and that means keeping the foot on the monetary bank despite Wall Street’s wailing otherwise.