Is inflation over? Kind of, but not really

Timothy P. Carney

Video Embed

Economics is complicated, and economic measures are varied and nuanced. That allows partisans, particularly those who are experts in economics, to argue anything they want by wrangling the right statistics.

Such is the case with inflation today.

KAMALA HARRIS ADMITS SHE IS ANTI-LIFE

You will see the Biden administration and its defenders saying that inflation is over, while the numbers say that inflation is 6.5%. What’s going on here? Is everybody just lying? Who’s right? Who’s wrong?

The key here is to understand that different measures of inflation are ways of answering different questions. There is no single ontological “inflation,” and so there is no single “right” measure of inflation.

There is a “right” number, or at least better and worse measures, to answer particular questions.

That’s because when we say “inflation,” we’re talking about a few different things at once. Most basically, normal people mean “how much more expensive my life is getting.” They might mean something even more specific: “how much more expensive my life is than it was last year when we set my salary.”

Policymakers might be talking about something else though. They might mean “how much is money supply in excess of demand for money or in excess of the quantity of stuff people want to buy?”

So here are different ways to look at current inflation, depending on what question you’re asking:

How much should I get in a cost-of-living adjustment? 6.5%

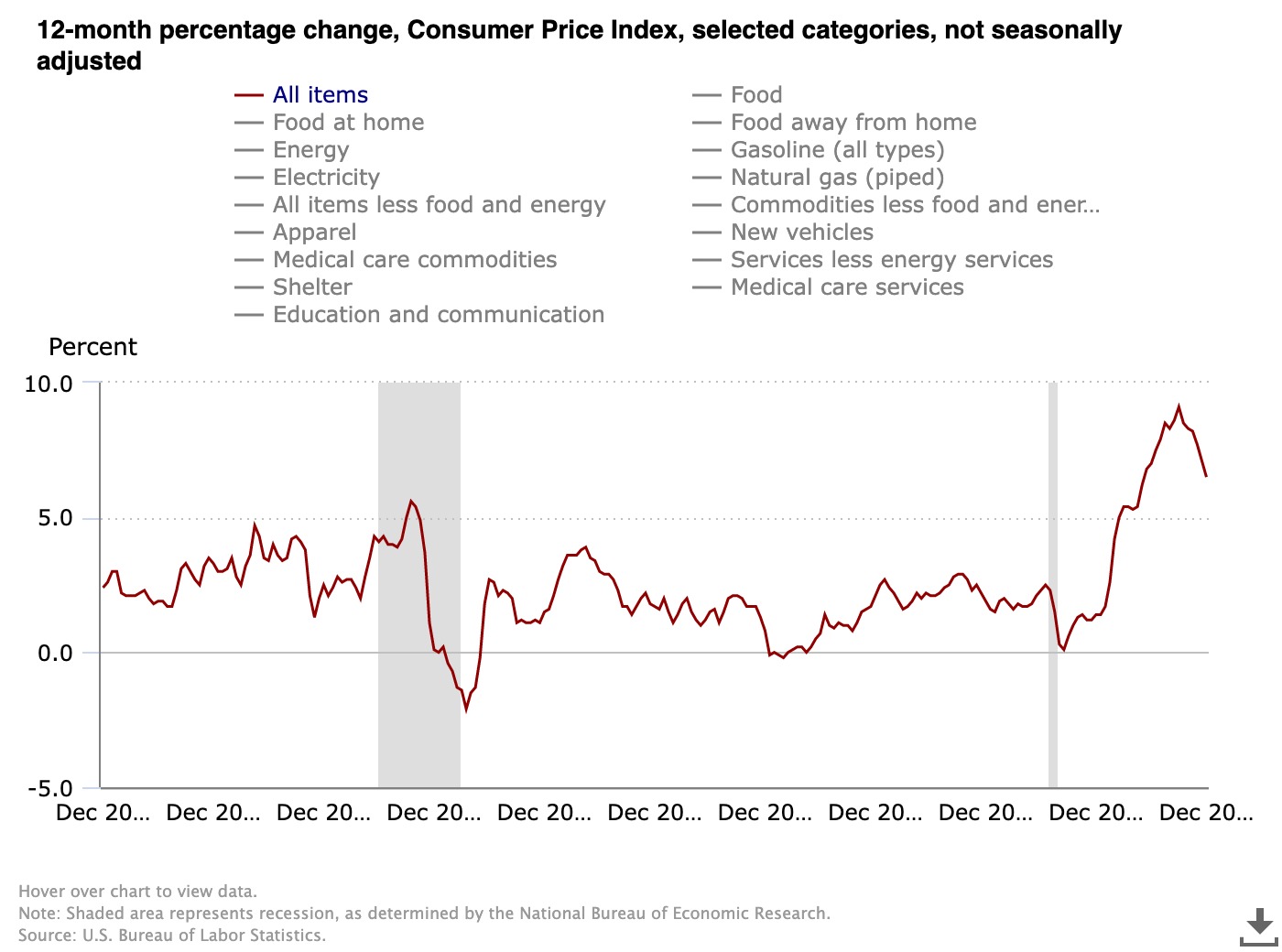

This was the headline inflation number for December. It is the 12-month percentage change in the consumer price index.

This number has been falling since August, when it hit 9.1%. Prices of course haven’t been falling, but this number measures how much more expensive is life than it was one year ago this month.

Over the four years of Trump, this number averaged 2.2%. So 6.5% year-over-year inflation represents a lot of price increase over the past year. If you got an annual raise this month of less than 6.5%, your purchasing power actually went down.

Is life still getting much more expensive on average? Not really.

That 6.5% is a measure of change in prices. How are actual prices?

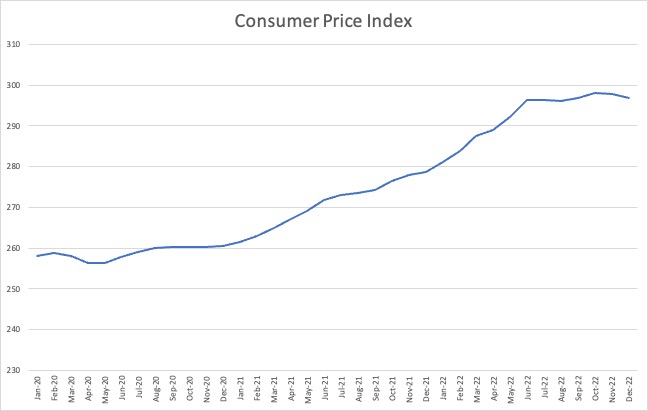

Well, according to the CP, prices basically stopped rising over the summer. Check out this chart of the CPI.

That number, which climbed slowly, then skyrocketed when Biden showed up, and has been flat for six months, captures what the average household pays for all the stuff the household buys. So for the average household, life stopped getting more expensive this summer.

But that’s not the whole story because there’s plenty under the surface.

Runaway inflation for most things you buy continued into the fall, and then in the last couple of months, we’ve had more normal inflation. But at the same time, gasoline prices have fallen, offsetting this inflation for the average household. So let’s look at a number that captures what most things are doing pricewise while leaving out the outliers.

Is inflation still happening? Yes, but it slowed down in the fall.

Here are a couple of telling measures of inflation: median CPI and “trimmed-mean CPI.”

iFrame Object

These are measures of inflation that basically exclude the things that went up a lot or down a lot in price. These don’t tell you whether life is getting more expensive because it leaves out the stuff like gasoline that got cheaper or like eggs that got much more expensive. These numbers are more macroeconomic indicators than anything else.

Inflation, as an economics question rather than a family finances question, is basically a question of more money chasing less stuff.

According to these measures, median and trimmed-mean CPI, inflation was very hot until October, and since then has calmed down.

The Bottom Line

The bottom line is that the average family’s life stopped getting more expensive in June thanks to falling gas prices but that Biden-era extraordinary inflation really only petered out this past fall.

CLICK HERE TO READ MORE IN THE WASHINGTON EXAMINER