Good inflation news doesn’t mean the Fed pivot is coming in 2023

Tiana Lowe

Video Embed

In a vacuum, the news that consumer price inflation is at 6.5% on an annualized basis, more than three times what the Federal Reserve considers acceptable, would hardly be welcome news. But after a year of inflation approaching double digits, investors continued their celebration, staging a market rally nigh on two weeks now.

But although Wall Street may welcome the most subtle sign of sunshine as confirmation that the inflation threat is over, the white whale that is the “Fed pivot” still will not come this year.

INFLATION DROPS TO 6.5% IN DECEMBER AS PRICE PRESSURES EASE

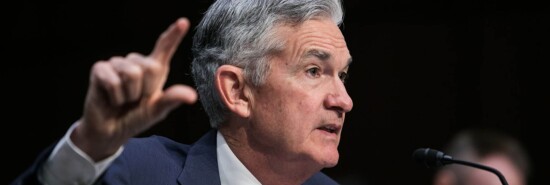

After finally ending the Fed’s failed experiment with quantitative easing and zero interest rates, Jerome Powell has brought interest rates to their highest point since before the Great Recession. Not only has the Fed finally caught nominal interest rates up within striking distance of core inflation, but it has also telegraphed that the era of zero interest rates is over for good. The quantity theory of money has been vindicated, and as a result, the Fed predicts that interest rates will average more than 5% for this year and more than 2% in the long term.

Inflation has been cooling from its 40-year highs for six months now precisely because the Fed has refused to heed the demands of either cash-starved investors or Democrats. It has contracted the money supply by a full percentage point since March. And so markets are now rallying because people expect “the pivot” to arrive, perhaps even this year. Futures markets are currently pricing in a rate cut by July, with rates not topping 5%. Two-year Treasury yields also tumbled upon the consumer price index release, a signal that the market predicts an incoming pivot.

Just as they were wrong about inflation proving transitory, investors are wrong about this. Powell will not suddenly embrace the progressive fantasy of a 4% inflation benchmark. The Fed, after allowing this initial inflation crisis to begin, will not allow a double-dip recession by taking the foot off the brake and letting inflation rebound.

Fundamentals of the CPI basket remain concerning. Although overall price levels did decrease from November to December, core CPI increased. At the same time, wages and employment are likely too hot for the Fed’s comfort.

The December report is obviously a step in the right direction, but markets are once again deluding themselves if they think it has changed the Fed’s game.

CLICK HERE TO READ MORE FROM THE WASHINGTON EXAMINER