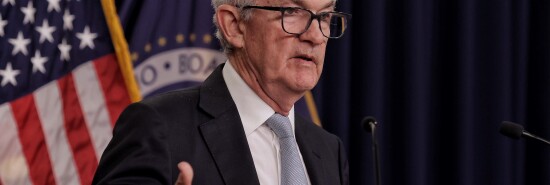

Bond markets get ahead of Jerome Powell, again

Tiana Lowe Doescher

Video Embed

At the final Federal Reserve meeting of the year, the central bank has telegraphed more of the same. It held the federal funds rate at 5.25% to 5.5% and once again signaled that contrary to the hopes of investors, it would stay the course of “higher for longer.”

Whereas futures markets anticipate the federal funds rate will fall to 4% by the end of next year, the Federal Open Market Committee forecast just three 25-basis point cuts over the course of 2024, with a median federal funds rate of 4.6% according to its final Summary of Economic Projections of 2023.

INFLATION SLOWS TO 0.9% IN NOVEMBER IN PRODUCER PRICE INDEX

As Fed Chairman Jerome Powell reiterated for the thousandth time during Wednesday’s press conference, the Fed’s war on inflation is still not won. The Fed projects that core personal consumption expenditures inflation fell to a median of 3.2% for the year, still more than a full point above its 2% maximum target. While the low unemployment projections indicate that the Fed sees a soft landing in its midst, nothing about either the Fed’s projections or statements indicate that they have abandoned the mantra of “higher for longer.”

And yet, bond markets broke out the champagne. Upon the release of the Fed’s projection, the 10-year Treasury yield plummeted from nearly 4.2% to a hair north of 4.0%. Recall that the yield had soared to 5% as recently as two months ago.

In this week’s magazine, I argued that the Fed has macroeconomic reasons not to race to cut interest rates:

The best argument for the Fed’s “higher for longer” approach is that unlike the 2020 COVID-19-induced recession or even the 2008 financial crash, the rest of the government is tapped out for stimulus funds. In the case of a real and possibly ruinous economic downturn, the federal government cannot afford another CARES Act or American Rescue Plan. Net interest costs are due to supersede annual defense spending by 2027. And already, net interest payments are consuming a staggering 30 cents of every tax dollar received by Uncle Sam. The Fed has three major tools in its arsenal to conduct monetary policy. Theoretically, it can reduce required reserve ratios for banks to unleash a deluge of liquidity — but those reserve ratios are already zero! Second, it can theoretically finance federal spending through quantitative easing, what critics call “money printing.” But with inflation still at more than 3%, well above the Fed’s ironclad target of 2%, it’s hard to imagine that Powell would want to do the same thing that triggered the worst inflation in 40 years in the first place.

The FOMC seems to agree with me. The markets do not. Only time will tell, but I personally wouldn’t bet against Powell.